Found 40 movies, 25 TV shows, and 0 people

Can't find what you're looking for?

Three weeks have gone by since the alien spaceship crash landed on the Graviton City spire, and since then the aliens have been hard at work converting their ship to a pleasure district, hoping to make friends with the humans!… Not. Perpetually late and continually over-eating A-ko, spacy and cheerful C-ko, and brilliant and bold B-ko are about to enter summer break from school, and it just so happens the alien ship is open for business. When a free meal turns into a sob story about how the aliens just want to go home, will it be A-ko or B-ko who can get the ship into orbit again?

Sacho the financial ninja saves the common folk from corporate villains with the use of her "financial ninjutsu."

End-of-the-century financial survival

A neurotic man relates his unsuccessful attempt to open a simple savings account at a bank.

No description available for this movie.

No description available for this movie.

Glauber Contessoto gambles his life savings on a joke cryptocurrency. Two months later, he becomes "The Dogecoin Millionaire" and an internet legend. While it might seem easy to get rich online, it's even easier to lose it all.

Alex Jones interviews Walter Burien, commodity trading adviser (CTA) of 15 years about the biggest game in town. There are over 85,000 federal and regional governmental institutions: school districts, water and power authorities, county and city governments – and they own over 70 percent of the stock market.

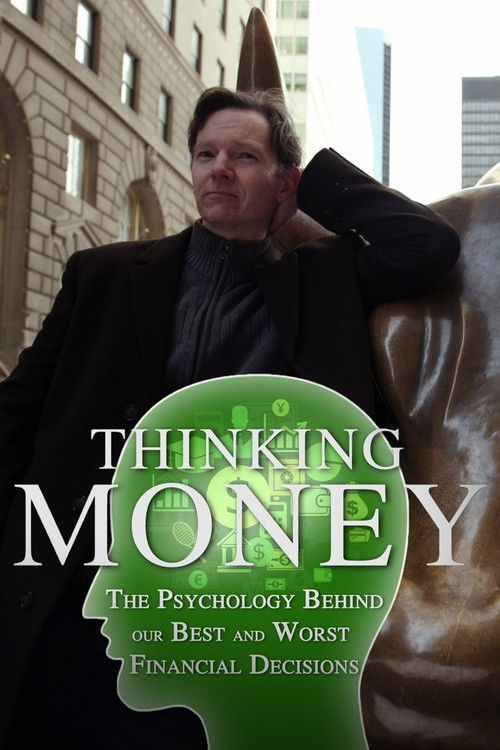

Thinking Money is an hour-long exploration on public television of what behavioral economics has to tell us about how and why we spend, save (or don't) and think about money. It presents some of the country's most innovative thinkers who mix economics with psychology. Their experiments and insights into our financial behavior enlighten and often amuse as we learn to recognize how both our brains and the marketplace can trick us into spending money we shouldn't. The program explores a whole raft of techniques, apps, websites and ways of thinking that help us to save for the types of things that make our lives more secure: emergency funds, our kids' education, and ultimately our comfortable retirements. A mix of fascinating theory and practical takeaways, Thinking Money is designed to decrease the stress and increase the bandwidth in not just our finance, but our whole lives.

The Financial Crisis (Session I-IV) is a 12-minute filmwork in which SUPERFLEX addresses the financial crisis from a therapeutic perspective. A hypnotist guides us through our worst economic nightmares. During four sessions, the audience is invited to speculate on the hypnotic forces of global capitalism, as well as experience the fear, anxiety and frustration of losing control, economic loss and personal financial disaster. In “Session 1: The Invisible Hand,” we are introduced to the backbone of capitalism, the idea of the “invisible hand” as the benign force of self-regulation that prevents markets and people from spinning out of economic control. We are asked to interrogate our faith in this force, and to imagine a world no longer governed by this invisible hand. In the following sessions we are guided deeper and deeper into the subconscious of the financial crisis with “Session 2: George Soros,” “Session 3: You,” and “Session 4: Old Friends.”

This documentary looks at the factors that led to the 2008 financial crisis and the efforts made by then Treasury Secretary Henry Paulson, Federal Reserve Bank of New York President Timothy Geithner, and Federal Reserve Chair Ben Bernanke to save the United States from an economic collapse.

When the world’s financial bubble blew, the solution was to lower interest rates and pump trillions of dollars into the sick banking system. But what happens when the solutions are identical to the mistakes that caused the very crisis?

Unveiling a hidden scandal affecting a group of former players of the Premier League, the world's biggest and richest football league.

This film was produced in the early 90s and with such pinpoint accuracy explains our current economic situation, its uncanny…almost prophetic. See what roads have lead America to its dependency on debt, and how you, as an individual, can escape it. America must borrow more than a billion dollars a day to help pay the interest on our national debt! What does this mean for our future? How can we protect our families? Hear expert economic analysis from Larry Burkett, Ed Meese, US Senator Trent Lott, and others.

War, a crime against humanity, becomes a profit tool in business. Hjalmar Schacht, Third Reich's chief economist, claimed, "The dollar started and won WWII." Newly revealed documents show the USA invested 474 million in the Third Reich by 1941. Major companies like Standard Oil, General Motors, ITT, and Ford profited from Nazi connections, exposing the darker side of wartime commerce.

Today's politically correct news media does not publish half of what is going on. This video told the financial story twenty years ago, and the facts have not changed. Excellent presentation and visuals for informing the general public.

Short film by Lu Chunsheng.

How to Enrich Yourself by Driving Women Into Emotional and Financial Bankruptcy

Director: Jean-Luc Martin

Brokers, stock exchange... The alluring and frightening world of money, where property, health, and even the lives of its characters are at stake. The gifted Ruslan becomes a financier at the suggestion of his childhood friend Tahir. Suddenly, in the course of stock market speculation, they come into conflict with people for whom human life is a bargaining chip.

A New York stockbroker refuses to cooperate in a large securities fraud case involving corruption on Wall Street, corporate banking world and mob infiltration. Based on Jordan Belfort's autobiography.

Jim is an average New Yorker living a peaceful life with a well paying job and a loving family. Suddenly, everything changes when the economy crashes causing Jim to lose everything. Filled with anger and rage, Jim snaps and goes to extreme lengths to seek revenge for the life taken from him.

In the glamorous world of New York City, Rebecca Bloomwood is a fun-loving girl who is really good at shopping – a little too good, perhaps. She dreams of working for her favorite fashion magazine, but can't quite get her foot in the door – until ironically, she snags a job as an advice columnist for a financial magazine published by the same company.

The men who made millions from a global economic meltdown.

This rich and nuanced portrait of the remarkable, elusive Rothschild family uncovers the story behind the family's phenomenal economic success. The film tells the dynasty’s incredible saga, from the confines of the Frankfurt ghetto to the halls of royal palaces, all the while emphasizing the importance they placed on family unity and the profound role Judaism played in their lives, later using their influence to assist oppressed Jews throughout Europe. A definitive work of documentary cinema with a thoroughly engaging narrative, The Rothschild Saga brings their mysterious and fascinating history to life.

In this reworking of "No, No, Nanette," wealthy heiress Nanette Carter bets her uncle $25,000 that she can say "no" to everything for 48 hours. If she wins, she can invest the money in a Broadway show featuring songs written by her beau, and of course, in which she will star. Trouble is, she doesn't realize her uncle's been wiped out by the Stock Market crash.

For three weeks in September 2008, one person was charged with preventing the collapse of the global economy. No one understood the financial markets better than Hank Paulson, the former CEO of Goldman Sachs. In Hank: Five Years from the Brink, Paulson tells the complete story of how he persuaded banks, Congress and presidential candidates to sign off on nearly $1 trillion in bailouts - even as he found the behavior that led to the crisis, and the bailouts themselves, morally reprehensible. Directed by Academy Award nominee Joe Berlinger (Paradise Lost Trilogy, Some Kind of Monster), the film features Paulson, and his wife of 40 years, Wendy. it's a riveting portrait of leadership under unimaginable pressure - and a marriage under unfathomable circumstances.

Elected in November 1932, as the economic crisis ravaged the United States, Franklin Delano Roosevelt immediately put all his campaign promises into action: it was time for the "New Deal". This bold plan, designed to turn around a nation on the brink of collapse, where unemployment was at an all-time high and the working poor were suffering from the precariousness of the job market, was intended to give hope to a country that had been battered before anything else. Once he came to power, the new president from the Democratic Party immediately passed some fifteen laws designed to revive the economy.

Third and final version of the La Cage aux Folles series has Renato's drag queen lover Albin learning that he can inherit a vast fortune from a distant relative. But the catch is that Albin must marry (a woman) and produce a heir within a year or the whole inheritance will be forfeited.

Nineteen-year-old Laura is stressed by her first year at college when money worries distract her from her studies and so, desperate for cash, she answers an online advertisement for intimate companionship that leads her down a dangerous path.

When Mary finds herself at the center of a public scandal and the family faces financial strife, the entire household grapples with the threat of social disgrace. The Crawleys must embrace change as the staff prepares for a new chapter with the next generation leading Downton Abbey into the future.

A thriller that revolves around the key people at an investment bank over a 24-hour period during the early stages of the financial crisis.

Jeff Bezos is not only one of the richest men in the world, he has built a business empire that is without precedent in the history of American capitalism. His power to shape everything from the future of work to the future of commerce to the future of technology is unrivaled. As politicians and regulators around the world start to consider the global impact of Amazon — and how to rein in Bezos’ power — FRONTLINE investigates how he executed a plan to build one of the most influential economic and cultural forces in the world.

Judith has known her husband Brice since they were children, but now their marriage is growing stale. Having just completed her graduate work in psychotherapy, she's eager to begin a career as a marriage counselor. She takes an internship at a matchmaking firm for millionaires and meets Harley, a charismatic billionaire investor who makes no effort to hide his attraction to Judith. Although quite resistant at first, eventually Judith succumbs to his charms, placing her marriage in jeopardy and forever altering the course of her life.

Nearly 100 years after its creation, the power of the U.S. Federal Reserve has never been greater. Markets and governments around the world hold their breath in anticipation of the Fed Chairman's every word. Yet the average person knows very little about the most powerful - and least understood - financial institution on earth. Narrated by Liev Schreiber, Money For Nothing is the first film to take viewers inside the Fed and reveal the impact of Fed policies - past, present, and future - on our lives. Join current and former Fed officials as they debate the critics, and each other, about the decisions that helped lead the global financial system to the brink of collapse in 2008. And why we might be headed there again.

A small-time thief steals a car and impulsively murders a motorcycle policeman. Wanted by the authorities, he attempts to persuade a girl to run away to Italy with him.

Gang leader Tony pulls off a major diamond heist with his crew, but cop-turned-criminal Ling knows who has the loot and responds by kidnapping Tony's daughter and holding her for ransom. Unfortunately, Tony's lost the diamonds as well. As he frantically searches for his daughter and the jewels, Tony pairs with a high-kicking government agent who once worked with Ling and seeks revenge on him.

Evil baddie Dr. Otto Von-Schnick-ick-ick tries to take over the planet by first destroying all of our financial systems, collapsing the world's economy and sending populations across the globe into mass panic! Only one goody-goody can stop him.. or can he? The oblivious Lance Sterling is on the case! With the aid of his underappreciated assistant Doris, will Lance manage to save the day and defeat Doctor Otto before the mad scientist's megalomaniacal plan is fulfilled? Or will the villain succeed in distracting them to their doom with his many convincing costumes, courtesy of his own convenient Changing Coffin? Tune in to find out!

Heist: Who Stole the American Dream? reveals how American corporations orchestrated the dismantling of middle-class prosperity through rampant deregulation, the outsourcing of jobs, and tax policies favoring businesses and the wealthy. The collapse of the U.S. economy is the result of conscious choices made over thirty five years by a small group: leaders of corporations and their elected allies, and the biggest lobbying interest in Washington, the U.S. Chamber of Commerce. To these individuals, the collapse is not a catastrophe, but rather the planned outcome of their long, patient work. For the rest of the country, it is merely the biggest heist in American history.

After she spends all her money, an evil enchantress queen schemes to marry a handsome, wealthy prince. There's just one problem - he's in love with a beautiful princess, Snow White. Now, joined by seven rebellious dwarves, Snow White launches an epic battle of good vs. evil...